For most trips, airfare is the most expensive part of the trip. While prices for transatlantic flights have gone down in recent years, they can still put a sizeable dent in any travel budget. Whether you’re a budget solo traveler or a family looking to vacation abroad, finding a cheap flight deal can be what makes or breaks your trip.

After all, if your flight is too expensive, you’re likely going to keep putting the trip off. I’ve seen it happen time and time again.

And yet every day, airlines have thousands of amazing deals — from mistakenly published fares to special promotions to slashing prices to compete with another airline. Cheap fares are out there and they can make your dream trip a reality — if you know where to look (I start all my flight searches with Skyscanner).

Today, I am going to help you master the art of finding a cheap flight. These are the exact steps I’ve been following for a decade to get the cheapest airfare possible every time I fly. If you follow them too, you’ll never be the person on a flight who paid the most for their ticket!

Here’s how to find a cheap flight no matter where you want to go in the world:

Table of Contents

- 1. Ignore the Myths

- 2. Be Flexible with Your Travel Dates and Times

- 3. Be Flexible with Your Destinations

- 4. Keep an Eye for Special Deals

- 5. Fly Budget Carriers

- 6. Don’t Always Fly Direct

- 7. Remember Not All Search Engines are Equal

- 8. Take Advantage of Student Discounts

- 9. Mix and Match Airlines

- 10. Use Points and Miles

- 11. Search Ticket Prices for Individual Travelers

- 12. Look for Tickets in Other Currencies

- 13. Book Early (But Not Too Early)

- 14. Book Hidden City Fares

- Find Your Cheap Flights Today

1. Ignore the Myths

The first thing to know about finding a cheap flight is that there is no magic bullet or one secret ninja trick to doing so. There are a lot of myths online about how to find cheap flights. In fact, you’ve probably come across a ton of them on your search to find the best flight deal!

They are all lies. They will lead you astray.

Most websites hire terrible reporters who recycle common and outdated myths. Here are the most common that are 100% not true:

- It is NOT cheaper to buy airfare on a Tuesday (or any other specific day for that matter).

- There is NO evidence that searching incognito leads to cheaper deals.

- There is NO exact date or specific time period in which to book your airfare.

- You can’t predict airline prices and websites that do are basically taking an educated (but probably wrong) guess.

Airlines use advanced computer and pricing algorithms to determine prices and run sales based on the time of the year, passenger demand, weather, major events/festivals, time of day, competitor prices, fuel prices, and much more. Those so-called “tricks” don’t work anymore. The system is too smart. Throw them out. Let them die.

Don’t listen to anyone who tells you otherwise. Anyone who is telling you doesn’t know what they are talking about.

2. Be Flexible with Your Travel Dates and Times

Airline ticket prices vary greatly depending on the day of the week, time of year, and upcoming holidays, such as Christmas, New Year’s Eve, Thanksgiving, or the Fourth of July. August is a big month for traveling around Europe, and everyone wants to go somewhere warm in the winter or travel when the kids are out of school.

In a nutshell, if you are going to fly when everyone is flying, then your ticket is going to cost more.

The solution is to fly off-season. Search alternative dates so that you can capitalize on the best day. The more rigid your plans, the less likely it will be that you find a deal.

Try to be flexible with your dates. If you are dead-set on visiting Paris, go in the spring or fall when fewer people visit and airfares are cheaper.

But if you want to go in the middle of August? You’re out of luck. Hawaii over Christmas? Good luck! Prices will be at their highest.

Moreover, it’s almost always cheaper to fly during the middle of the week than on a weekend because most people travel on the weekends and airlines hike their prices then. Prices are cheaper if you fly after or on a major holiday. Early-morning or late-night flights are also cheaper because fewer people want to travel then (who wants to wake up early?!). Fridays and Mondays are expensive because that’s when most business travelers fly.

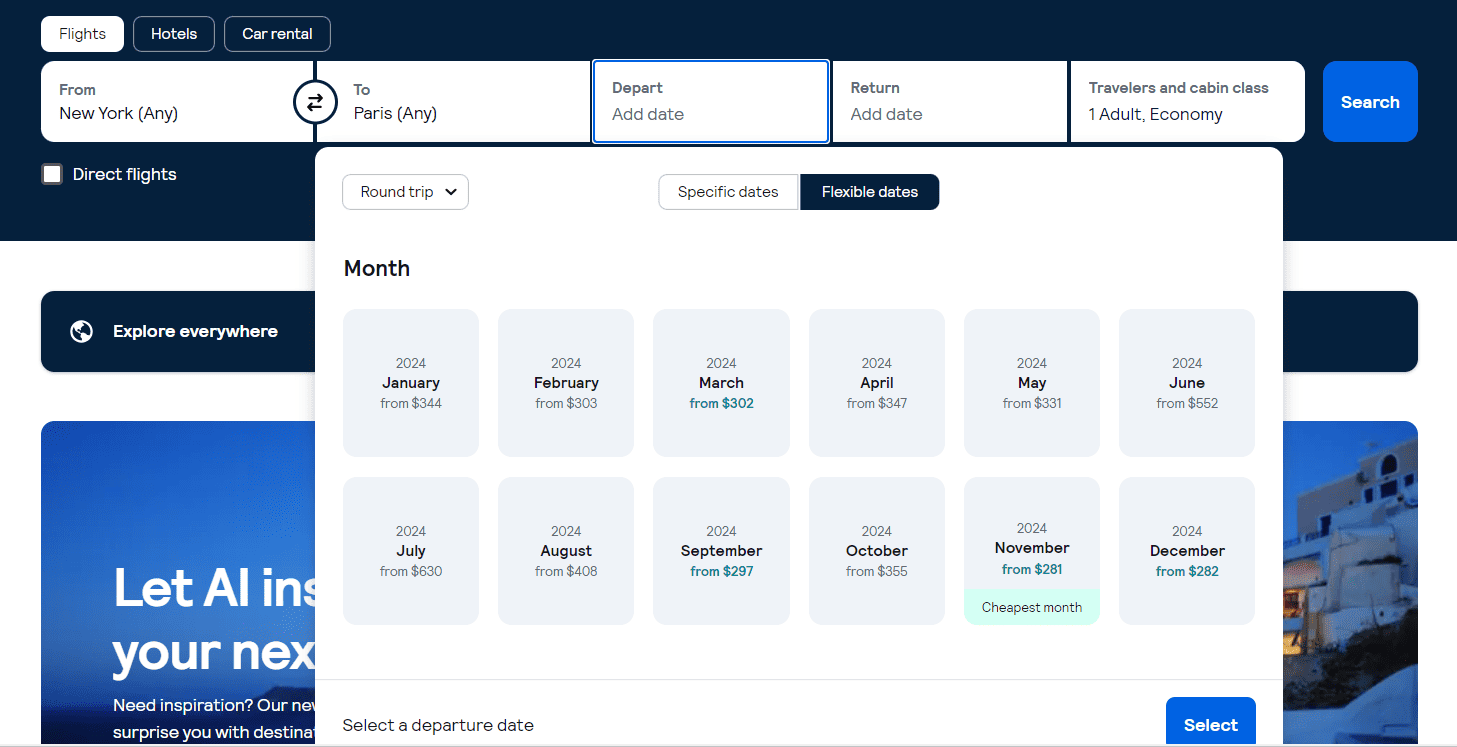

When searching on Skyscanner, simply click on the date field to expand the calendar view and you’ll immediately see the cheapest months to fly. On this search from NYC to Paris, you can see that traveling during September, November, or December would be half as much as traveling during June or July:

Airlines are not dumb. They know when a festival, holiday, major sports event, or school break is coming up — and they raise prices accordingly.

Be flexible with your dates and times and you’ll save yourself some major money.

3. Be Flexible with Your Destinations

If you can’t be flexible with when you fly, at least be flexible with where you fly. It’s best to be flexible with both, but if you really want to save the most money and get a cheap flight for your trip, you at least need to be flexible with one or the other.

Airline search engines have made it really easy to search the entire world to find the cheapest ticket. You no longer have to search manually, city by city, day by day. Websites like Skyscanner and Google Flights offer explore tools that allow you to put in your home airport and see a map of the world with all the flights on it. This allows you to easily compare multiple destinations without having to brainstorm every possible option. You’ll likely even find some interesting destinations you hadn’t even thought of either!

If you are flexible with where you want to go (i.e., anywhere but home), all you need to do is type “Everywhere” into the search box on Skyscanner or “Anywhere” if you’re using Google Flights.

The truth about airfare is that there’s always a deal to some destination — it might just not be your first choice. However, if you’re flexible about where you want to go, you’ll always get a deal and save a ton of money in the process.

When you are locked into one place at one time, you are stuck with whatever price shows up. Nothing can change that. But when you become flexible, suddenly the entire world opens up to you and you’ll find amazing cheap airfares!

4. Keep an Eye for Special Deals

Before you start looking for specific lights, make sure you’ve signed up for some newsletters. Joining the mailing list for airlines and last-minute deal websites will give you access to the absolute best deals out there. Sure, 99% of them might not fit your itinerary but keeping your eye on the deals will ensure you don’t miss an amazing opportunity.

More often than not, cheap flights are only available for a limited window (usually 24 hours). If you aren’t always scouring the web for sales, you’ll likely miss out on the best deals.

I would have missed out on a round-trip ticket to Japan for $700 USD (normally $1,500) as well as a $500 flight to South Africa if I wasn’t signed up to flight deal websites.

Additionally, airline newsletters often offer frequent flier bonuses. Those points and miles can add up to free flights and awesome upgrades.

Aside from joining airline newsletters, the best website for finding travel deals is Going (formerly Scott’s Cheap Flights). It’s the BEST for upcoming US flight deals and new users can get 20% off a Premium membership with the code NOMADICMATT20.

Other sites worth checking out are:

- The Flight Deal – Great for global flight deals.

- Holiday Pirates – The best for European flight deals.

- Secret Flying – A great site for flight deals from around the world.

5. Fly Budget Carriers

Years ago, if you wanted to fly between continents, you were mostly stuck with traditional expensive airlines. That’s no longer true. These days, you can fly most of the way around the world on a budget airline. Sure, they might not be as comfortable and you may need to pay for premium upgrades like checked bags and meals, but they bring the world to your doorstep without breaking the bank.

Budget airlines mainly service short and medium-haul routes. While many budget carriers (notably Norwegian Air) scrapped their long-haul routes during COVID, new ones (like PLAY, Norse Atlantic Airways, and French Bee) have now arisen to take their place.

For now, budget airlines mainly operate regionally so it’s really easy to find a cheap flight, even during this age of higher prices.

Flying budget airlines is a good alternative to flying “the majors” whenever possible. You get fewer perks, but you can save a bundle in price.

Just be sure to watch out for fees. That’s how they make money! Budget airlines often charge fees for checked bags, carry-ons, printing your boarding pass, using a credit card, and anything else they can get away with. Be sure to add up the cost of the ticket AND the fees to make sure that the price is lower than a larger carrier.

You’ll also want to double-check the location of the budget airline’s airport at your intended destination. These airlines often fly in and out of airports that are quite far from the actual city, with limited and expensive transportation options.

For example, the shuttle to Beauvais, the budget airport for Paris, costs 17 EUR one-way. If you’re flying roundtrip, this means that you should add about 34 EUR to the price of your plane ticket to see if you’re even saving much by flying a budget airline.

6. Don’t Always Fly Direct

Not only does it help to be flexible with dates and destinations but being flexible with the route you take is another way to get a cheap flight. For example, sometimes it’s cheaper to fly to London and take a budget airline to Amsterdam than to fly direct to Amsterdam from your departure city.

I did precisely this when I was going to Paris. The flight from the US was $900 USD, but I could fly to Dublin for $600 and get a $60 flight to Paris. It meant more flying time, but the $240 USD I saved was worth it to me.

To use this method, find out how much it is to go directly to your destination. Then, open Google Flights and type in that destination’s continent to look at prices to nearby airports. If the difference is more than $150 USD, I look to see how much it is to get from the second airport to my primary destination (either by budget flight or train, if it’s not too far). You can use Rome2Rio to help search for the best ways to get between a nearby airport and your primary destination.

You can also do this for leaving too. It might be cheaper to fly out from a nearby airport. I often search other airports to see if it’s cheaper to fly/drive/train there and then fly to my final destination. For long international flights, it can be worth the added time!

If you do book separate segments, be sure to have at least three hours between connections. This will give you space in case there is a delay as your second flight won’t wait for you (you booked with a separate airline, so they won’t care if you’re late or not).

Leaving a three-hour buffer will also cover you for an insurance claim since most insurance companies require you to have at least a 3-hour delay before you can make a claim.

This method is more work since you have to figure out lots of different routes and check different airlines. But it can lower the price of your flight, which is worth the extra effort if you end up saving a few hundred bucks.

Note: If you ever have a delayed flight to or from Europe, you might be owed additional compensation (upwards of 600 EUR). Here’s how to find out if you’re entitled to compensation!

7. Remember Not All Search Engines are Equal

In order to find the best deal, you need to search multiple websites. Many major search sites don’t list budget carriers or obscure foreign carriers because those airlines don’t want to pay a booking commission. Others don’t list booking sites that aren’t in English. And others still only display prices retrieved directly from airlines.

In short, not all flight search websites are created equal and all have their pros and cons.

Since there is no perfect airline search engine, you’ll want to search a few to compare. Even the best have their faults. That said, I have a few favorites I always start with as they tend to consistently show the best results. To me, the best websites to find a cheap flight are the following:

- Skyscanner – The best booking site out there. They have a great user interface (and a great app for mobile)

- Google Flights – Great search engine that lets you see prices for multiple destinations.

Typically, I start all my searches with Skyscanner because it searches all major AND budget airlines, non-English websites, English websites, and everything in between. They vet all the sites they link to as they have strict criteria on who they operate with. It’s one of the most comprehensive booking sites out there and they have the lowest price 99% of the time. I’ve been using them since 2008, and it’s the search engine all the other travel experts I know use too.

8. Take Advantage of Student Discounts

If you are a student (or under 26), there are many discounts available to you. You can usually find prices 10-20% off the standard fare. Travel agencies like Flight Centre and Student Universe can help find you a cheap ticket. Don’t overlook them!

Additionally, keep in mind that most student discounts transfer over to airline partners. For example, Lufthansa offers a student discount, which means you can use that discount on partner airlines such as Swiss Airlines and Austrian Airlines. This will allow you to go much further afield while still saving a ton of money.

If you’re not sure which airlines offer discounts (they don’t make this information easy to find), visit their website or call them. Doing a little digging to save 20% (or more) will be worth it!

9. Mix and Match Airlines

When you book directly with an airline, you’ll only be able to fly that airline and any partner airlines it has. That means your options will be limited when it comes to finding the perfect itinerary or saving the most money.

Usually, that will suffice. However, if you’re chasing greater savings, try booking your tickets on separate airlines. For example, if you’re flying from New York to Paris, you might have a stop in London. Booking both legs as one ticket will be simple, but it likely won’t save you money.

Instead, book your New York to London flight as one ticket and then your London to Paris ticket with another airline. That will allow you to shop around for the best bargain. It’s more work, but the savings (and flexibility) can be worth it.

This is what most third-party booking websites like Kiwi.com do. They piece together trips using whatever flights they can find to ensure you get the cheapest price.

If you’re hunting for the lowest possible price and aren’t happy with what you’re finding on the airline’s website, try booking separate segments. You might just stumble onto a great deal!

10. Use Points and Miles

As soon as you know you want to travel somewhere you should sign up for a travel credit card. Using points and miles is the #1 way avid travelers like me earn free flights, travel perks, and free hotel stays. Travel credit cards offer huge welcome bonuses, credit toward rideshares like Uber or Lyft, access to airport lounges, travel insurance, and much more.

You don’t need to do any extra spending either. I earn over a million miles a year — without flying or spending extra money. That translates into dozens of free flights (often in business class) for myself and my family.

If you are smart with your money and collect points and miles, you can travel around the world for very little (and often free). Here are some articles that can help you get started:

- Points and Miles 101: A Beginner’s Guide

- How I Earn 1 Million Frequent Flier Miles Every Year

- Is Collecting Points and Miles Really a Scam?

- The Ultimate Guide to Points and Miles

- The Ultimate Guide to Picking the Best Travel Credit Card

- The Best Travel Credit Cards for Travelers

If you already have some points and miles collected, consider joining a platform like point.me. It’s a search and booking engine that helps you find the best ways to use your points and miles. It searches 30+ loyalty and 100+ airline programs to find the best value possible so you never waste your miles! Get your first month for just $1 with the code NOMADICMATT.

11. Search Ticket Prices for Individual Travelers

If you’re traveling with friends or family, don’t search for or buy multiple tickets in a single purchase. Airlines always show the highest ticket price in a group of tickets which means you’ll end up paying more money.

Airlines have tons of different price points for tickets (these are based on a variety of factors). They want to sell tickets in the highest fare bucket possible and, when they group tickets together, always list prices in the highest fare bucket.

For example, if you are a family of four and you’re searching for four seats, the airline will find four seats together and show your fare based on the highest ticket price. So if seat A is $200, seats B and C are $300, and seat D is $400, it will price those tickets as $400 each instead of adding up the individual ticket prices. If the price difference is large, that translates into a sizeable extra expense.

For that reason, always search for tickets as a single person. Afterward, in the checkout process, you can pick your seats so you and your family are sitting together. And even if you end up not beside one another, that’s a fair trade for saving a few hundred dollars.

12. Look for Tickets in Other Currencies

If your country’s currency is currently strong compared to others around the world, search for airfare in a country where the currency is weaker.

For example, when the US dollar was strong and the New Zealand currency weak, I found a one-way flight from Australia to NYC for $1,000 USD. However, when I searched on the New Zealand version of the airline, I found the same ticket for $600 USD.

It was the same airline, same flight, and same booking class — it was just booked in a different currency. This tip does not always work, but it works often enough that it’s something worth trying if your currency is currently doing well.

(Tip: Always use a no-foreign-transaction-fee card to avoid paying a surcharge.)

13. Book Early (But Not Too Early)

Airline fares keep rising the closer you get to departure, but there is a sweet spot when the airlines begin to either lower or increase fares based on demand. Don’t wait until the last second but don’t book far, far in advance either. The best time to book your flight is around 2-3months before your departure, or around five months before if you are going to your destination during their peak season.

This isn’t a hard and fast rule, though, so use it as a guide. I could go on forever about airline pricing models but airlines raise prices closer to departure because the people who book last minute tend to be price insensitive business travelers so they will pay whatever. So don’t book last minute!

This is a more advanced (and riskier) way of finding cheap flights, but if you’re adamant about spending as little money as possible, it’s worth looking for hidden city fares. This is when you book a flight that has a layover in your desired destination. You then get off the plane and exit the airport at the layover city instead of continuing onto the final destination that you booked the ticket for.

For example, say you want to fly from Austin to Atlanta. A flight from Austin to New Orleans with a stop in Atlanta might be cheaper than booking Austin to Atlanta directly.

As you can imagine, this practice can get complicated and tricky. There are a few crucial elements to keep in mind, namely that once you skip a leg, the airline cancels the rest of your trip. That means that you cannot buy round-trip flights and do this practice on your departure flight, because your return flight will be cancelled. Also, you cannot check bags, as they will end up in the final destination on your ticket, not where you get off.

Additionally, airlines strongly frown upon this practice, so you don’t want to advertise that this is what you’re doing, and you don’t want to do it often, otherwise you might get flagged.

All that being said, you can save hundreds of dollars with hidden city flights, and it’s perfectly legal. It’s easy to search for hidden city flights on the website Skiplagged. Just do so at your own risk!

Finding a cheap flight is all about being flexible and getting creative. It may take some effort, but the deals are out there if you’re willing to look. Follow the tips above to get started, but don’t waste hours and hours hunting for a cheap flight. If you’re spending more than an hour booking a flight, you’re spending too much time.

Once you find a flight deal that you’re happy with, book right away, as airfares change by the minute. Remember that you have a 24-hour window to cancel in case you need to.

Use the tips above on how to get a cheap flight to get the ball rolling. Do that, and you’ll always get a great deal!

Find Your Cheap Flights Today

I start all my searches with Skyscanner because they search all major AND budget airlines, non-English websites, English websites, and everything in between. Even if you aren’t sure of your plans, it’s best to start searching for flights today. People who wait to book are people who end up spending the most.

Use this widget to plan your next trip:

READ NEXT —-> How to Put This Into Practice: 5 Step-by-Step Instructions for Booking a Flight

Disclosure: Please note that some of the links above are affiliate links. At no additional cost to you, I earn a commission if you make a purchase. If you have any questions about the companies or my status as an affiliate, please don’t hesitate to email me.