Last Updated: 11/30/23 | November 30th, 2023

I’ve used World Nomads as my travel insurance provider a lot over the years and, though I’ve written about travel insurance in the past, I’ve never properly reviewed World Nomads.

They were the first company I ever used and I’ve continued to use them throughout the years as I’ve traveled. Since I get asked a lot about them, today, I want to share my review of World Nomads Travel Insurance with you.

Here’s everything you need to know about World Nomads travel insurance:

Table of Contents

- Who are World Nomads?

- What’s Included in World Nomads Insurance Policies?

- EMERGENCY MEDICAL COVERAGE

- EMERGENCY DENTAL TREATMENT

- LOST OR STOLEN BAGGAGE

- COVID-19

- TRIP CANCELLATION, INTERRUPTION, OR DELAY

- 24/7 ASSISTANCE

- What’s NOT Covered By World Nomads

- What You Can Do With a World Nomads Policy

- Additional Things to Remember

- Travel Insurance Claims

- My Experience Using World Nomads

Who are World Nomads?

World Nomads is a travel insurance distributor based in Australia. It was founded in 2002 by travelers who wanted to address the three key concerns: freedom, safety, and connection.

Now, the insurer provides coverage to people from more than 100 countries, offers overseas emergency medical and dental cover for sudden illness and injury, medical evacuation and repatriation coverage, 24-hour emergency assistance, some coverage for COVID-19, cover for lost, stolen or damaged baggage, cancellation cover, and coverage for a over 150 types of adventure activities.

I originally found them via Lonely Planet (but they were also featured in National Geographic and Rough Guides). There are a lot of travel insurance providers out there, but World Nomads was designed for backpackers and budget travelers, which is why I decided to go with them on my first big trip around the world.

What’s Included in World Nomads Insurance Policies?

World Nomads has two plans: Standard and Explorer. The Explorer Plan typically has a higher premium because it has a higher level of coverage that includes all the benefits of the Standard Plan and a few more, with higher benefit limits.

World Nomads covers some higher-intensity activities and sports, even on the Standard Plan. Not all activities, sports, and experiences are covered under every plan and the coverage varies by the country you’re visiting and where you’re from, so always check before purchasing a policy.

Other benefits and services may include:

EMERGENCY MEDICAL COVERAGE

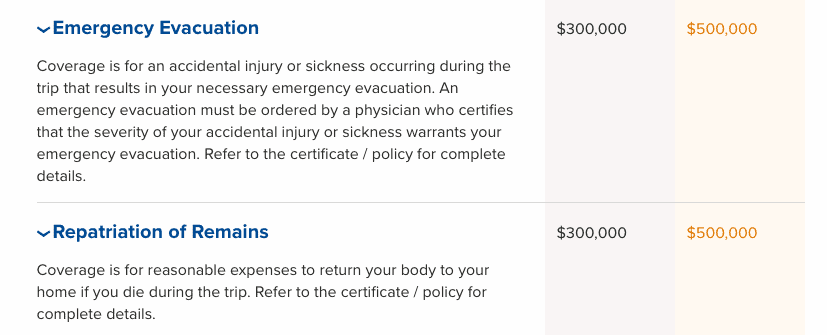

World Nomads offers cover for overseas emergency medical expenses for accidents or sudden illnesses on both the Standard and Explorer plans.

Its policies also offer coverage for expenses related to medical evacuation or repatriation if you’re accidentally injured. For example, if you’re hiking in the woods and you break your leg, your policy may cover your evacuation to the nearest hospital or back to your country of residence (if deemed medically necessary).

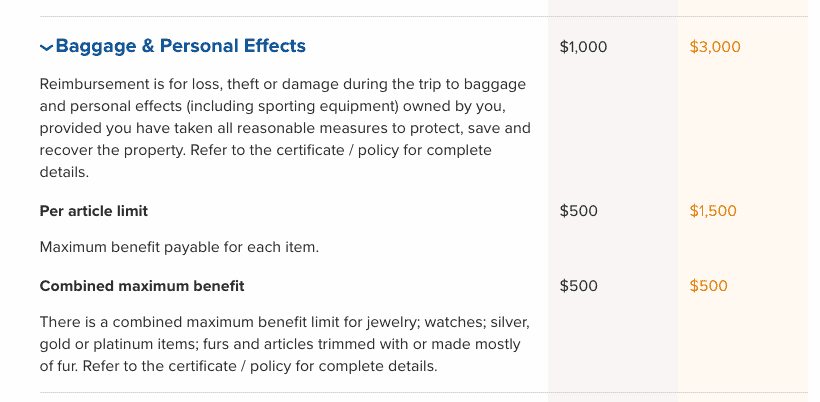

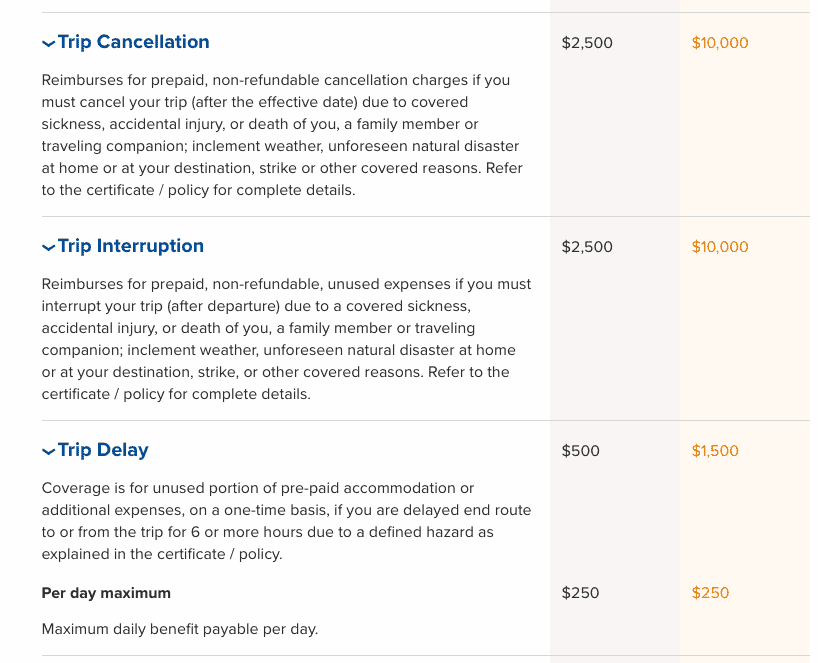

In the images below, the coverage amounts in the left column are for the Standard Plan, while the prices in the right column are for the Explorer Plan.

EMERGENCY DENTAL TREATMENT

World Nomads also covers emergency dental treatment for accidental injuries that occur during the trip. It does not include standard dental work, such as checkups or cleanings, fillings, or root canals and the like (or things that can wait until you get back home), however, if you get an injury then that may be covered.

LOST OR STOLEN BAGGAGE

If your baggage and personal belongings are lost, stolen, or damaged during the trip, coverage may be available. You may also be reimbursed for extra essential item expenses if your baggage is delayed by an airline or carrier. The minimum timeframe of the delay will vary depending on your country of residence.

COVID-19

World Nomads offers some coverage for events related to COVID-19, such as emergency medical, trip delay, and trip interruption coverage if you contract COVID-19 while traveling. Be sure to read the policy wording to understand what’s covered and what the benefits are as these vary depending on your country of residence.

TRIP CANCELLATION, INTERRUPTION, OR DELAY

If your trip is canceled, interrupted, or delayed (must be due to events specified in the policy wording), World Nomads can offer cover for your nonrefundable prepaid expenses.

24/7 ASSISTANCE

World Nomads provides a 24/7 service to assist travelers in sticky situations or emergencies. The service can help you locate medical providers. They can also assist with transportation, including an escort, if required, to a medical facility for treatment, or home, if deemed necessary.

What’s NOT Covered By World Nomads

Here’s a list of key items and situations not covered:

- Alcohol or drug-related incidents.

- If you’re reckless, acting in an irresponsible manner or not complying with local laws.

- Pre-existing conditions or general check-ups. Read the policy for full details.

- Lost or stolen cash (can vary depending on your country of residence or plan)

- Participation in a sport or activity not listed in the policy wording, or one that’s offered by World Nomads, but you haven’t purchased the required level of cover.

- Not following doctors’ orders: disobeying your treating doctor’s directions and/or those of World Nomad’s Emergency Assistance team.

- Stolen, lost or damaged personal belongings that were left unguarded.

What You Can Do With a World Nomads Policy

- Buy additional coverage if you extend your travel dates.

- Purchase a policy while already on a trip (waiting periods apply)

- Make a claim online

- Access 24/7 Emergency Assistance

Additional Things to Remember

- There are age restrictions that apply depending on your country of residence.

- Its online system can be a little confusing to figure out.

- They offer limited gear/electronics coverage. Also, while using your gear, it won’t be covered.

- You can’t get “cancel for any reason” coverage.

- It doesn’t cover anything related to pre-existing conditions.

- World Nomads premiums vary in cost based on your age, destinations, where you’re from, and your country of residence.

Travel Insurance Claims

I’ve been traveling for over 15 years and have only had to make a few claims during that time. Fortunately, for most travelers, travel insurance is something we buy but never have to use.

However, if you do get into a situation where you need to make a claim, there are a couple things that can help.

First, before a trip, I always make sure to save copies of all of my receipts and travel information in my inbox so that I can submit them to World Nomads if I need to make a claim. I also save their emergency phone and email contacts in my phone and inbox so that I can easily contact them in an emergency.

The more documentation you have about your claim, the faster and easier it will be processed. Claims can be submitted online; you simply start a claim, follow the prompts, and submit your documents. World Nomads will follow up if they need anything else from you.

Here are a few things that may make your claiming process easier:

- Injury or illness? Call their assistance teams ASAP and make digital copies of any related receipts.

- Take a photo of your luggage before your trip in case something happens to it (especially your valuable gear).

- If an airline loses your things, tell them straight away, fill in their paperwork and keep a copy.

- Theft? Report it to the police as soon as possible. Keep all documentation from the police.

- Check what refunds you can get first from your transport or accommodation providers. Only if they can’t help should you go to your insurance provider

Making a claim isn’t fun by any means, but it’s quick and simple to do thanks to World Nomad’s online portal. And, since they have 24/7 support, you can reach out to them if you have problems or questions.

My Experience Using World Nomads

I’ve had to make claims twice during my time using World Nomads. The first time was when South African Airlines lost my luggage on the way back from Africa. I called to ask what I could do. They told me that I would have to wait to see if the airline would reimburse me first. If the airline would not reimburse me within 90 days, they would. (Travel insurance is about making you whole, not making sure you make a profit.)

Luckily, the airline paid me, and I didn’t need to be reimbursed by my travel insurance policy, but I learned through this process that if you have all your documents and proof, the claims process can be a lot easier.

Another time, in Argentina, I was suffering from anxiety and worried that it was something more. It felt like someone was stomping on my chest. I contacted Emergency Assistance and they took my information and symptoms and gave me a list of emergency doctors that they recommended. They were helpful, quick, and got me a doctor right away. I was very happy with the service and know that if something really does go wrong, they act quickly.

Nobody likes to think about what might go wrong when they travel. But if you plan ahead and ensure that you have suitable coverage, you can travel with confidence knowing that, should something go wrong, you’ll be made whole and have access to a team that can help you navigate the situation.

I never leave home without insurance. You shouldn’t either.

CLICK HERE TO LEARN MORE ABOUT WORLD NOMADS.

World Nomads provides travel insurance for travelers in over 100 countries. As an affiliate, we receive a fee when you get a quote from World Nomads using this link. We do not represent World Nomads. This is information only and not a recommendation to buy travel insurance.

Book Your Trip: Logistical Tips and Tricks

Book Your Flight

Find a cheap flight by using Skyscanner. It’s my favorite search engine because it searches websites and airlines around the globe so you always know no stone is being left unturned.

Book Your Accommodation

You can book your hostel with Hostelworld. If you want to stay somewhere other than a hostel, use Booking.com as it consistently returns the cheapest rates for guesthouses and hotels.

Don’t Forget Travel Insurance

Travel insurance will protect you against illness, injury, theft, and cancellations. It’s comprehensive protection in case anything goes wrong. I never go on a trip without it as I’ve had to use it many times in the past. My favorite companies that offer the best service and value are:

- SafetyWing (best for everyone)

- Insure My Trip (for those 70 and over)

- Medjet (for additional evacuation coverage)

Want to Travel for Free?

Travel credit cards allow you to earn points that can be redeemed for free flights and accommodation — all without any extra spending. Check out my guide to picking the right card and my current favorites to get started and see the latest best deals.

Need Help Finding Activities for Your Trip?

Get Your Guide is a huge online marketplace where you can find cool walking tours, fun excursions, skip-the-line tickets, private guides, and more.

Ready to Book Your Trip?

Check out my resource page for the best companies to use when you travel. I list all the ones I use when I travel. They are the best in class and you can’t go wrong using them on your trip.